Categories

Mortgage, Real Estate Trends, Roof MaintenancePublished October 31, 2025

Don’t Fear Today’s Mortgage Rates

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Mortgage Rates: The “Monster” Under the Bed Isn’t So Scary. If you’ve been holding off on buying a home because of mortgage rates, you’re not alone. Every time rates rise a little, many buyers think, “Maybe I’ll just wait until they drop below 6%.” But here’s the reality: that perfect “5-point-something” rate might not actually save you as much as you think, and waiting could cost you more in the long run.

The “Magic Number” Myth

According to the National Association of Realtors (NAR), if rates dropped to 6%, it would suddenly make the median-priced home affordable for about 5.5 million more households including 1.6 million renters.

That’s a huge surge of potential buyers entering the market. When that happens, demand spikes, competition heats up, and home prices start climbing again.

So while waiting for that “perfect” rate might feel smart, by the time rates hit that level, you’ll be competing with more buyers for fewer homes, and that could easily erase any savings from a slightly lower rate.

Let’s Look at the Numbers

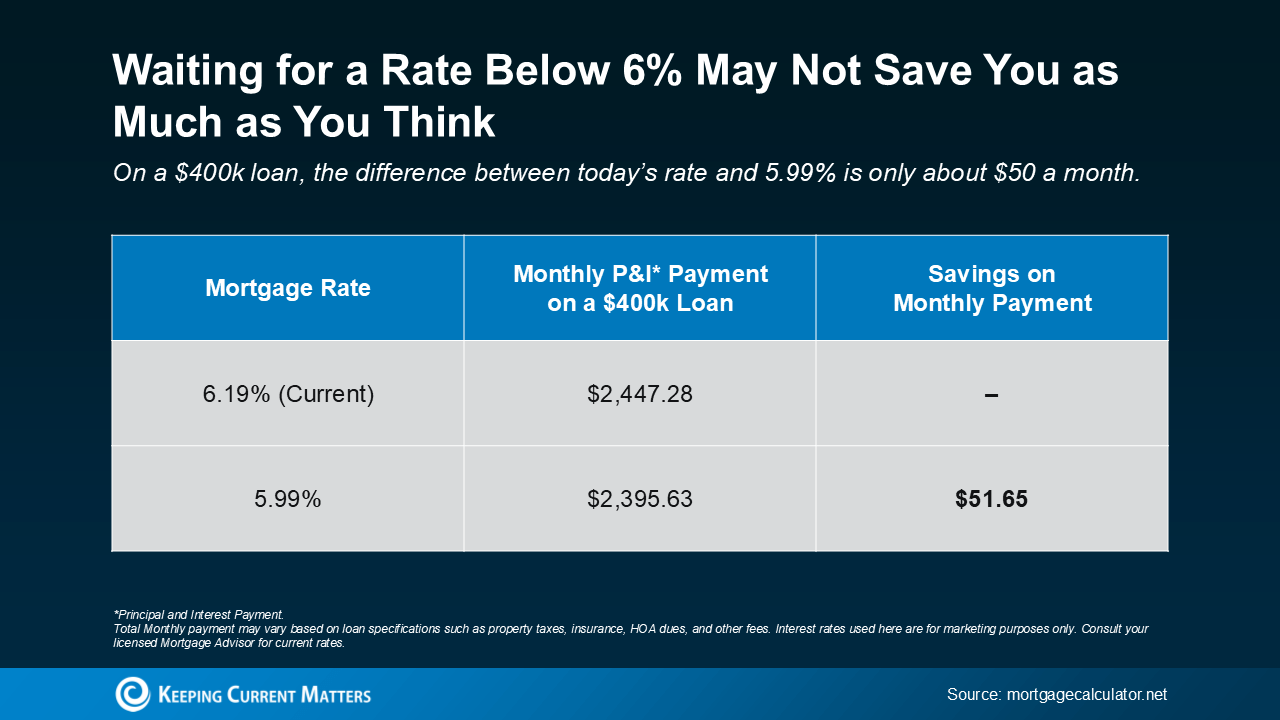

(Photo credits: Keeping Current Matters) Mortgage payment comparison chart showing difference between 6.19% and 5.99% mortgage rates on $400k loan

On a $400,000 loan, the difference between today’s average rate (6.19%) and a 5.99% rate is about $51 per month, that’s roughly what many people spend on one dinner out or a few coffee runs.

So the question becomes: is it worth waiting months (or longer) for a $50 savings, especially if home prices climb thousands in the meantime?

Why Acting Now Could Make Sense

Right now, you have more leverage than you might later. Sellers are motivated, inventory is improving, and competition is lower than what we’ll likely see when rates dip under 6%.

As Jessica Lautz of NAR puts it: “Over the last 5 weeks, mortgage rates have averaged 6.31%. This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices.”

And as Matt Vernon, Head of Retail Lending at Bank of America, explains: “Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation—if the house is right for them, and the payments are affordable, it could be the right time to make a move.”

The Big Picture: Timing the Market Rarely Wins

It’s natural to want the best deal possible, but trying to “time” mortgage rates can backfire. While rates may inch down slightly, the combination of higher prices and more buyer competition often means you’ll end up paying more overall.

If you’re financially ready, steady income, manageable debt, and a home that fits your lifestyle, now could be your best opportunity before the next wave of buyers jumps back in.

Bottom Line: Don’t Let Fear Cost You an Opportunity

Waiting for rates to drop below 6% might feel like playing it safe, but in today’s market, it could mean missing out on your dream home and paying more down the road.

If you’re ready to make your move or just want to explore what’s possible in today’s market, I’d be happy to guide you through your options.

Call or text me directly at (240) 401-8023

Related Articles You’ll Love

See your roof like never before with WeatherTek Home Exteriors. Our advanced drone inspections give you a clear, detailed view of your roof’s condition so you can make confident decisions about your home. Protect your investment with reliable craftsmanship and honest expertise.

CALL US at 443-332-3035 today to schedule your FREE Roof Evaluation. Check us out at www.weathertekhomeexteriors.com for more details on the services we offer.

Images may be subject to copyright.

.png)